July Monthly Report: Deteriorating Fundamentals Affirm Gloomy Projections

The month was a bumpy one... What's ahead?

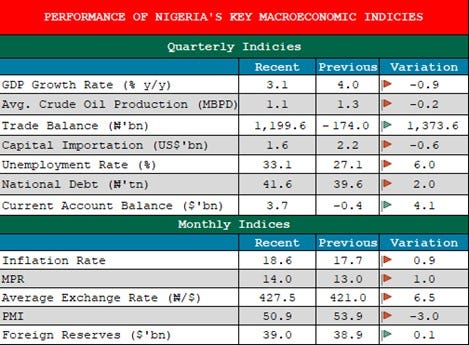

Domestic Macroeconomy: Deteriorating Fundamentals Affirm Gloomy Projections

Much in line with our year beginning macroeconomic theme for 2022 – A Mix of Boom and Gloom– the third quarter of 2022 kickstarted with more worrisome developments across the globe. Across the world, soaring inflation remained unabated, causing central banks to maintain their regime of monetary policy normalization. Similarly, economic growth projections have taken a beating with another downward review from the IMF following depressing developments and expected underperformances. Meanwhile, Nigeria’s unresolved legacy issues magnified its weak fiscal capacity and casts a frail outlook. With more focus on local developments, we provided context to happenings that shaped the month of July.

Our lens is first focused on the outcome of the 286th bi-monthly policy meeting of the Monetary Policy Committee (MPC) of the CBN. The committee once again raised the benchmark rate for the second time in quick succession by 100bps to 14.0% (May: 150bps to 13.0%) while retaining all other parameters. The back-to-back MPR hike was targeted at curbing the unabating inflationary pressure. Prior to the meeting, the NBS had reported that headline inflation rate rose further by 88bps to 18.6% y/y in June – the highest in 65-months. The headline inflation pressure was driven jointly by the 111bps and 85bps spike in food and core inflation sub-components to 20.6% and 15.7% y/y, respectively. We believe these increases underscore the pass-through impact of the lingering geopolitical tension in Ukraine on energy cost, input prices, and imported food. Also, structural challenges affecting food production & preservation as well as Naira depreciation in the month (NAFEX: 1.3% and Parallel market: 1.2%) contributed to the uptick in consumer prices. Overall, we believe the MPR hike alone, though compelling, would not sufficiently curb inflationary pressure in the near term, due to lingering impact of structural bottlenecks and counter-productive policies.

Away from the macroeconomic pointers, the Medium-Term Expenditure Framework & Financial Stability Plan (MTEF & FSP) of the FG presented during the month showed that the 2022 budget implementation suffered a major setback between January and April. Over the reviewed period, actual revenue (₦1.6tn) underperformed the pro-rata size (₦3.3tn) by 50.9%, due to underperformance of revenues from oil & gas (-58.1%), non-oil tax (-16.0%), and other non-oil revenue (-62.5%). Meanwhile, actual expenditure (₦4.7tn), though short of the pro-rata size by 18.3%, was three times (3x) the size of actual revenue over the period. Correspondingly, actual debt service (₦1.9tn) for the period usurped the pro-rata amount by 47.0%, while the debt-service to revenue indicator printed at 118.9% (year-end 2021: 96.0%) – indicating worsening fiscal vulnerability. Given the prevailing domestic and external headwind, and the lack of political will to tackle legacy challenges headlong, we are less optimistic of any near-term improvement in Nigeria’s fiscal condition. Hence, we retain our year beginning projections that budget deficit and debt-service to revenue rate would top ₦10.0tn and 85.0% respectively.

Chart 1: Performance of Macroeconomic Indices

Global Equities Market: Materialization of Downside Risks Dent Global Economic Outlook

In the month of July, the recovery witnessed in 2021 and efforts put forth by fiscal and monetary authorities globally to sustain it, suffered further setback. The runaway global inflation triggering tighter financial conditions, a worse-than-anticipated slowdown in China (due to new COVID-19 outbreaks and lockdowns), and negative spillovers from the Russia-Ukraine crisis further dented the global economic outlook. As such, the IMF in its July 2022 WEO Update titled, “Gloomy and More Uncertain” revised further downwards the global growth projection for the year to 3.2%, 0.4ppts lower than April’s forecast. Notably, the downgrade reflects a slowdown in three of the largest economies – US (New: 2.3%, Old: 3.7%), China (New: 3.3%, Old: 4.4%), and Euro Area (New: 2.6%, Old: 2.8%).

Although the IMF hinted that a global recession may be unlikely, the newly released GDP numbers for the US suggest otherwise. In Q2:2022, the US economy contracted by 0.6% y/y (Q1-2022: -1.6%), technically dragging the world's largest economy into a recession. The downturn in the economy was driven by the significant rise in global energy and commodities prices, coupled with tighter financial conditions. Meanwhile, the US Fed in its July FOMC meeting raised interest rate by another 75bps to a range of 2.25% and 2.50% (close to the neutral rate), to curtail the spiraling inflation which rose to a 41-year high of 9.1% in June. Additionally, the US Fed Chairman, Jerome Powell, noted that interest rate may keep rising, risking further economic downturn, until there is evidence that inflation is retreating. Nevertheless, all is not gloomy for the US economy, as some key macro indicators remain firm. We have seen a retreat in oil prices since mid-June pulling the price of gas and other commodity costs lower; supply chain bottlenecks that triggered product shortages are easing; the dollar has strengthened, cutting the price of imported goods, though export would dwindle; and the US employment rate remains stable at 3.6% - the lowest level since the pandemic outbreak.

Similarly, the Euro Area inflation rate rose to a record high of 8.9% in July, an increase from 8.6% in June. The spike can be attributed to a 39.7% and 9.8% y/y rise in energy and commodity prices respectively, triggered by higher transport costs, shortages, and uncertainty around Ukrainian supply. Given the current situation, the ECB raised interest rates on the main refinancing operations, marginal lending facility and deposit facility by 0.50%, 0.75% and 0.00% respectively - the first time since 2011 - while signaling another boost in September. Meanwhile, the Euro Area economy expanded by 0.7% y/y in Q2:2022 (Q1-2022: 0.6% y/y) beating analysts' consensus. Although Germany experienced a stagnation, France, Italy, and Spain exceeded expectations posting growth of 0.5%, 1.0% and 1.1% respectively. In the UK, inflation hit a new 40-year high of 9.4% in June (May: 9.1%), as increases in prices of food and energy persisted. Despite the BoE hiking interest rates five consecutive times by 25bps, inflation remains unabated. Nevertheless, BoE Governor Andrew Bailey suggested that the MPC consider hiking interest rates by 50bps in August, in a bid to return inflation to its 2.0% target.

In the BRICS region, we saw a positive equities market performance in Brazil (4.1% m/m), India (8.6% m/m) and South Africa (3.9% m/m) owing to the positive sentiment witnessed in the AEs. In China, GDP growth slowed to 0.4% y/y in Q2:2022 (Q1-2022: 4.8% y/y) as demand shrunk due to the impact of the lockdown measures against COVID-19. Additionally, inflationary pressure nudged higher to 2.5% y/y in June (May: 2.1%) following the ease of restrictions towards the latter end of Q2. In Russia, the equities market fell 17.1% m/m amid the lingering crisis with Ukraine. In the African market, bearish sentiment was triggered by widespread capital flight while increase in oil prices spurred a bullish sentiment in the Asian and Middle East markets.

Moving forward, we expect inflation to remain elevated owing to supply-related shocks to food and energy prices from the Russia-Ukraine crisis. As such, global central banks are expected to maintain tighter monetary conditions. Further, we expect the increase in borrowing costs to exacerbate pressure on the external reserves of EMDEs, leading to further currency depreciation.

Chart 2: Global Equities Market Performance

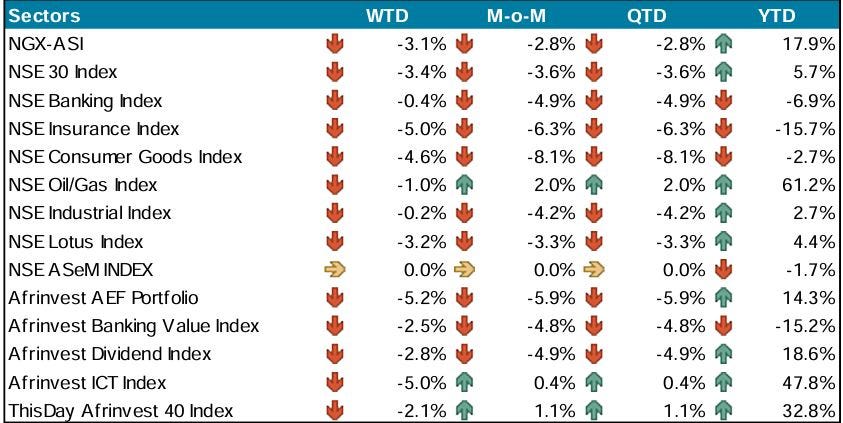

Domestic Equities Market: Bearish Momentum Lingers… ASI down 2.8% m/m

Keeping to the trend in the prior month, the domestic market closed the month of July in the negative region as the benchmark index fell 2.8% m/m (June: -3.4%) to 50,370.25 points. Meanwhile, average volume and value traded in July grossed 172.0m units and ₦2.6bn units respectively compared to 276.9m units and ₦3.7bn in June. The top traded stocks by volume for the month were TRANSCORP (443.8m units), GTCO (295.6m units), and UBA (261.6m units) while MTNN (₦21.6bn), GTCO (₦5.9bn), and ZENITH (₦4.3bn) led trades by value.

Performance across sectors within our purview was negative as 4 indices closed in the red while the other 2 indices appreciated. The Consumer and Insurance Goods indices led laggards, down 8.1% and 6.3% m/m respectively following price depreciation in HONYFLOUR (-25.7%), NB (-18.9%), MANSARD (-14.0%), and LASACO (-12.6%). Also, the Banking and Industrial Goods indices dipped by 4.9% and 4.2% m/m sequentially, on the back of losses in STANBIC (-15.4%), UBN (-10.6%), and WAPCO (-11.4%). Conversely, price uptick in SEPLAT (+10.0%), AIRTELAF (+10.0%), and CWG (+13.8%) drove the Oil & Gas and AFRI-ICT indices higher by 2.0% and 0.4% m/m, respectively.

Investor sentiment, as measured by market breadth, weakened to -0.8x from 0.0x recorded last month as 18 stocks gained, 61 lost while 56 were unchanged. The top performing stocks for the month were MULTIVER (+840.0%), ACADEMY (+45.7%), and JOHNHOLT (+18.7%) while HONYFLOUR (-25.7%), JAPAULGO (-23.3%), and COURTVILLE (-21.6%) were the top underperforming stocks. In August, we anticipate lingering macroeconomic headwinds and rising fixed income yields to sustain bearish momentum in the equities market despite the impressive H1:2022 earnings by major corporates.

Chart 3: Domestic Equities Market Performance

Foreign Exchange Market: Naira’s Woes Deepen in the Parallel Market

Worries about possible recession and imposition of price ceiling on global prices of crude oil by major economies dampened demand outlook, thereby outweighing the impact of tight supply in the global crude oil market. Consequently, the average Brent crude oil price fell 8.3% m/m to $112.49/bbl. in July (June: $122.71/bbl.).

Domestically, Nigeria’s foreign reserves rose 0.2% m/m to $39.3bn as of July 27th, 2022. Meanwhile, the local currency remained under pressure across the FX markets. Specifically, the Naira depreciated 0.9% and 16.3% m/m to ₦429.00/$1.00 and ₦715.00/$1.00 at the Investors’ & Exporters’ (I&E) Window and parallel market, respectively. We attribute this depreciation to the persistent demand-supply imbalance, invoked by depressed capital importation flows (Q1:2022 - $1.6bn vs Q1:2020 - $5.9bn), weak proceed from crude oil exports (as output shortfall lingers), and elevated import bills (c. $4.5bn monthly). Likewise, the activity level in the I&E Window weakened as gross turnover fell 34.9% m/m to $2.1bn in July.

At the FMDQ Securities Exchange (SE) FX Futures Contract Market, the total value of open contracts fell slightly, down 0.1% m/m to $3.8bn. In the trading month, the JULY 2023 instrument (contract price: ₦453.88) saw the most buy interest with an additional subscription of $40.3m (+403.1% m/m) – thus taking the instrument’s total value to $50.3m. In August, although we expect the Naira to trade within a similar band across market segments, we do not rule out the possibility of wider divergence between the official and parallel market rate given the subsisting exchange rate management strategy.

Money Market: Funding Rates Rose as Liquidity Trims… Sell Pressure Extended in The Secondary Market

System liquidity was lean in July despite OMO maturities (₦60.0bn) and Primary Market Repayment (₦143.3bn). Thus, system liquidity closed July at ₦22.4bn (previously: ₦366.7bn). As such, OPR and OVN rates advanced 665bps and 714bps m/m to 14.8% and 15.0% respectively.

In July, the Apex bank conducted two rounds of NTB auctions which recorded strong buying interest due to the high liquidity level following various maturities. The CBN mopped up ₦407.5bn out of the ₦465.9bn total subscriptions. On average, stop rates across all instruments rose with the 91, 182, and 364- day bills advancing 135bps, 686bps, and 153bps m/m respectively to 2.8%, 4.1%, and 7.0%.

The bearish performance in the secondary market for NTB was extended, as the average yield rose 138bps m/m to 6.9% in July (up 155bps m/m in June). Sell pressure was recorded across the yield curve following a 105bps, 245bps, and 64bps increase in the 91, 182, and 364-day bills, respectively. The bearish performance in the market was in line with movements in average stop rates in the primary market as investors repriced assets.

In August, we expect the CBN to continue with its liquidity management as ₦578.7bn worth of instruments (NTB and OMO) hit the financial system. For the secondary market trading, we expect continued expansion of yields, reflecting the tighter liquidity conditions.

Bonds Market: Yields Trend Higher as Liquidity Evaporates

In line with our expectation, the performance of the domestic secondary debt market was bearish in July as the average yield rose 68bps m/m to 12.0% due to weak system liquidity level. Yields rose across the short, mid, and long ends of the curve, up 1.9%, 0.7%, and 0.2% m/m respectively.

In the primary market, the Debt Management Office (DMO) held its bond auction for July where it reopened the FGN MAR 2025 (10-year), FGN APR 2032 (10-year), and FGN JAN 2042 (20-year) instruments. Across tenors, the bid-to-cover ratio stood at 0.2x and 0.3x for the FGN MAR 2025 and FGN APR 2032 instruments respectively, indicating under subscription while the FGN JAN 2042 was oversubscribed at a bid-to-cover ratio of 1.4x. At the end, a total amount of ₦123.8bn was allotted - MAR 2025 (₦5.3bn), APR 2032 (₦17.8bn), and JAN 2042 (₦100.7bn) at stop rates of 11.0%, 13.0% and 3.7% respectively, compared to 10.1%, 12.5%, and 13.2% in the prior auction.

Flight-to-safety sentiment deepened in the sovereign Eurobonds markets as the average yield rose 8.6ppts m/m to 33.8% amid continuing interest rate hikes in AEs. The Zambian 2022 instrument sold off the most (up 255.8ppts m/m to 606.7%) as it approached maturity. Similarly, bearish sentiment encompassed the Corporate Eurobonds space stirring the average yield up by 0.6ppts to 9.8%. Nigeria’s FIDELITY 2022 instrument recorded the most selloffs as the yield rose 2.7ppts m/m to 15.1%.

In August, we expect inflows from bond coupon payments (₦66.8bn vs ₦116.4bn in July) to support secondary market activities. However, this inflow would be insufficient to drive a reversal in yields in the month. Hence, we expect a bearish performance to persist in the domestic bond market.