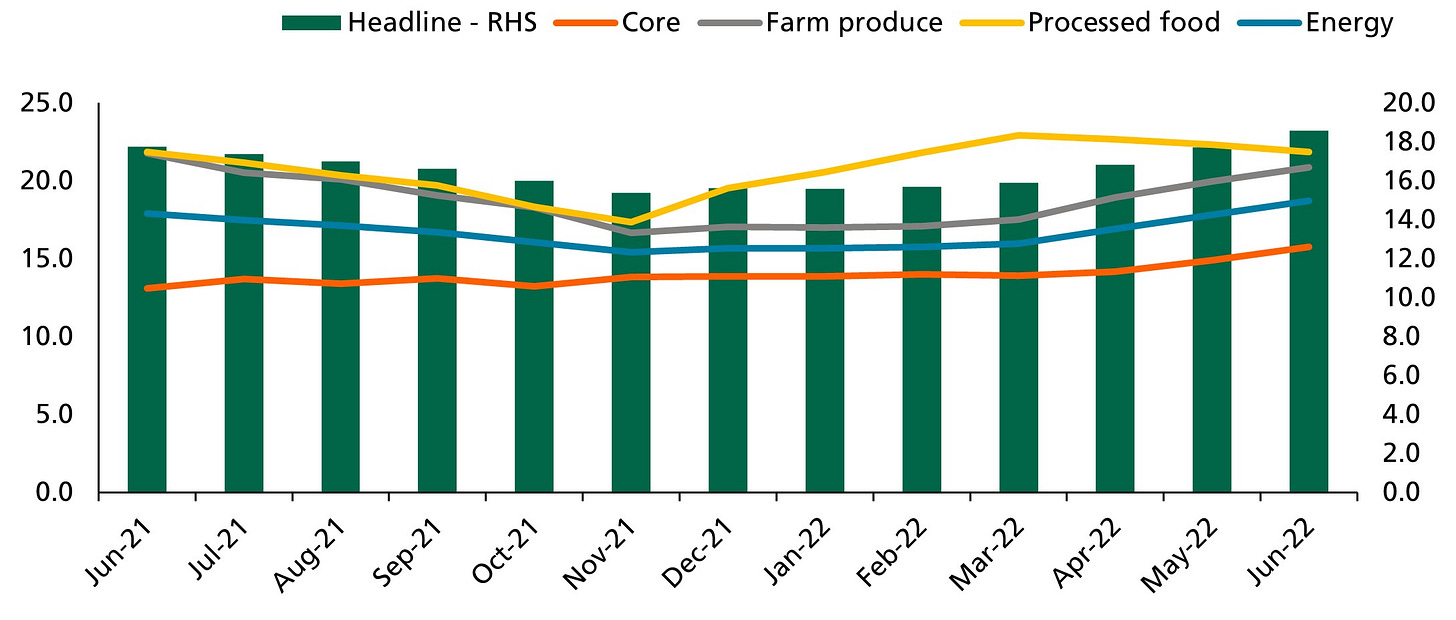

Famous American economist Milton Friedman once said inflation is taxation without legislation. The trend in domestic inflation since the start of the year has made it quite easy to understand what Friedman meant. As of June, the 12-month average annual rate of price increase of consumer goods and services was 16.5%. It would take 4.5 years to lose half of the value of your money at that rate. In the race to build wealth in a slow-growing economy, this is a damning reality.

While much has been said about the raging inflation that has decimated consumer purchasing power (read our July 15 weekly report for more on the June CPI report), the spotlight should be on what to do to avoid losing one’s wealth to the greatest “tax master”.

Headline Inflation Has Maintained an Uptrend Year-long to a 65-month high in June

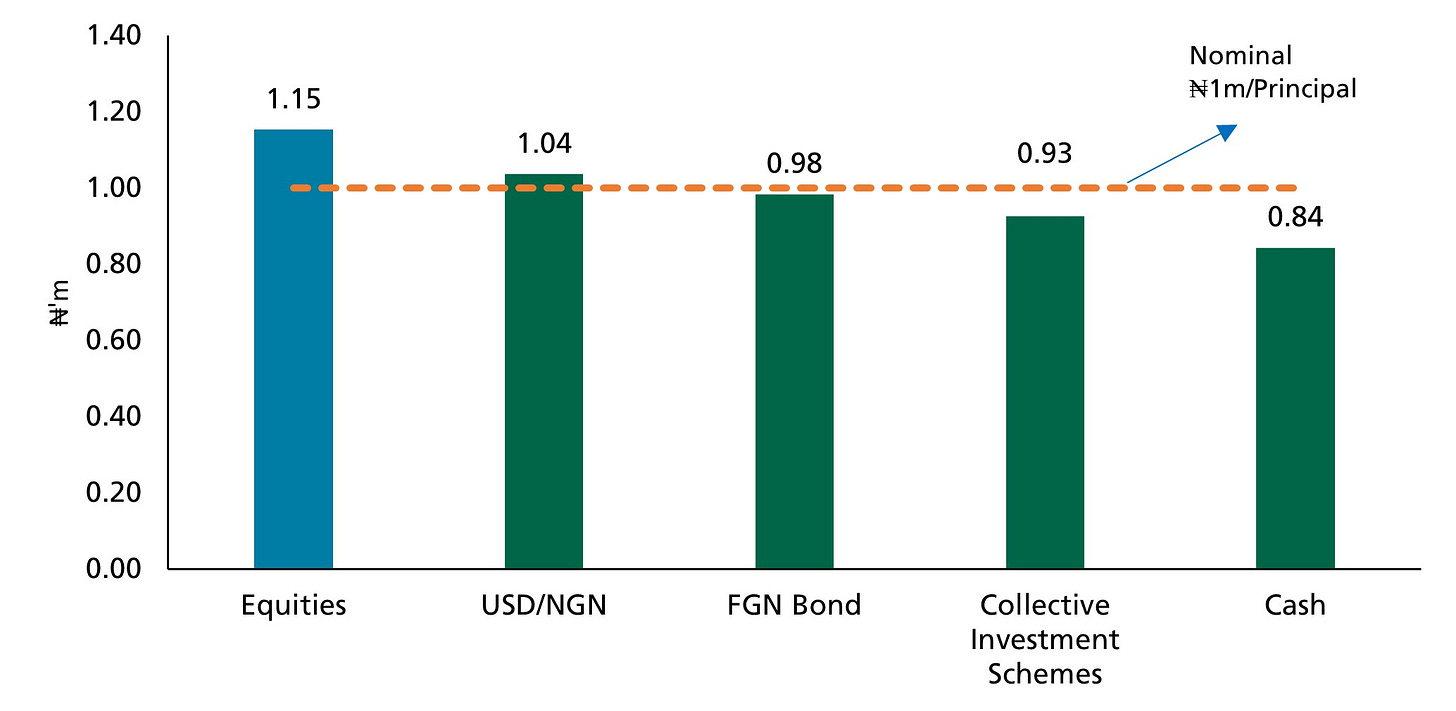

We looked through the traditional asset classes available to investigate how they performed over the past one year and adjust their performance based on inflation trends. To start with, we understand that beating inflation is a long game, but it helps not to lose money even over the short-term, and as you would see later, we provided a long-term view to staying ahead of inflation. Also, our analysis of asset returns strictly focuses on capital gains for equities and does not incorporate the cost of transactions across markets. In the same vein, the analysis is broad-based i.e., does not spotlight outliers within an asset class.

To begin, let’s assume you had a million naira (₦1,000,000) at the end of June 2021 and held on to that amount as cash. We found that based on NBS CPI data, the real value of your cash would be ₦843,201.49 as of June-end 2022. This means that you would need a nominal sum of ₦1,185,956.16 to be able to afford what cost one million naira just a year ago.

Considering the return across Collective Investment Schemes (Equity-based Funds, Money Market Fund, Bond/Fixed-Income Funds, Dollar Funds, Real Estate Investment Trust, Balanced Funds, Ethical Funds, & Shariah Compliant Funds) in the past year to June, you would have a nominal return (inclusive of principal) of ₦1,097,398.58 and a real value of ₦925,328.12 as of June-end 2022.

Similarly, holding the million naira in Dollars (based on Parallel Market rate) or FGN Bonds over same period would have yielded nominal returns (inclusive of principal) of ₦1,228,595.89 and ₦1,166,441.52 respectively, which translates to real values of ₦1,035,953.89 and ₦983,545.23. While the result for the former is good in terms of capital preservation, only investing in equities provided tangible capital appreciation over the period. Specifically, the one-million-naira capital yielded ₦1,366,956.16 in nominal returns (inclusive of principal) based on capital gains from June 2021 to June 2022. In real terms, this translated to ₦1,152,619.47, which beats inflation.

1-Year Inflation-Adjusted Value of ₦1m Held Across Select Assets till June 2022

While conventional wisdom supposes that risker assets should present better upsides and beat inflation, we found that over a 5-year period, FGN Bonds and Collective Investment Schemes outperformed equities and even USD while the real value of a million naira held as cash plunged to ₦514,269.79. Based on this analysis we found that winning ways to outperform inflation would require an active management strategy spearheaded by experts like the Afrinvest Asset Management and professional research insights. In sum, we believe that while inflation is unrelenting and pervasive, there are shelters in which you can hide from this “tax master”.

Disclaimer: Herein, we have neither advised nor recommended any asset or group of assets for investment or related purposes. Kindly reach out to our team of experts for further discussion on how to navigate financial markets in these times.