CBN Survey Data: Galloping Ways & Means Hits New High

A timely securitisation of the W&M liability would be a win-win for the FG and the CBN

Photo by Ifeoluwa A. on Unsplash

This week, our attention is shifted to the Ways & Means (W&M) liabilities data obtained from the CBN’s website. For context, Ways & Means refers to the short-term credit facility provided by the CBN to the FG (to plug budget shortfalls) subject to limits imposed by law. According to the CBN data, claims on the FG through W&M rose to a new milestone, up 28.4% y/y to ₦19.9tn at the end of H1:2022 from ₦15.5tn recorded in H1:2021. Thus representing 82.1% of CBN’s total claims on the FG. In H1:2022 alone, c.₦2.5tn has been disbursed to the FG, indicating that total annualised disbursement might spike to ₦5.1tn (2021: ₦4.3tn).

Chart 1: Ways & Means Advances Hits New High

Source: CBN, Afrinvest Research

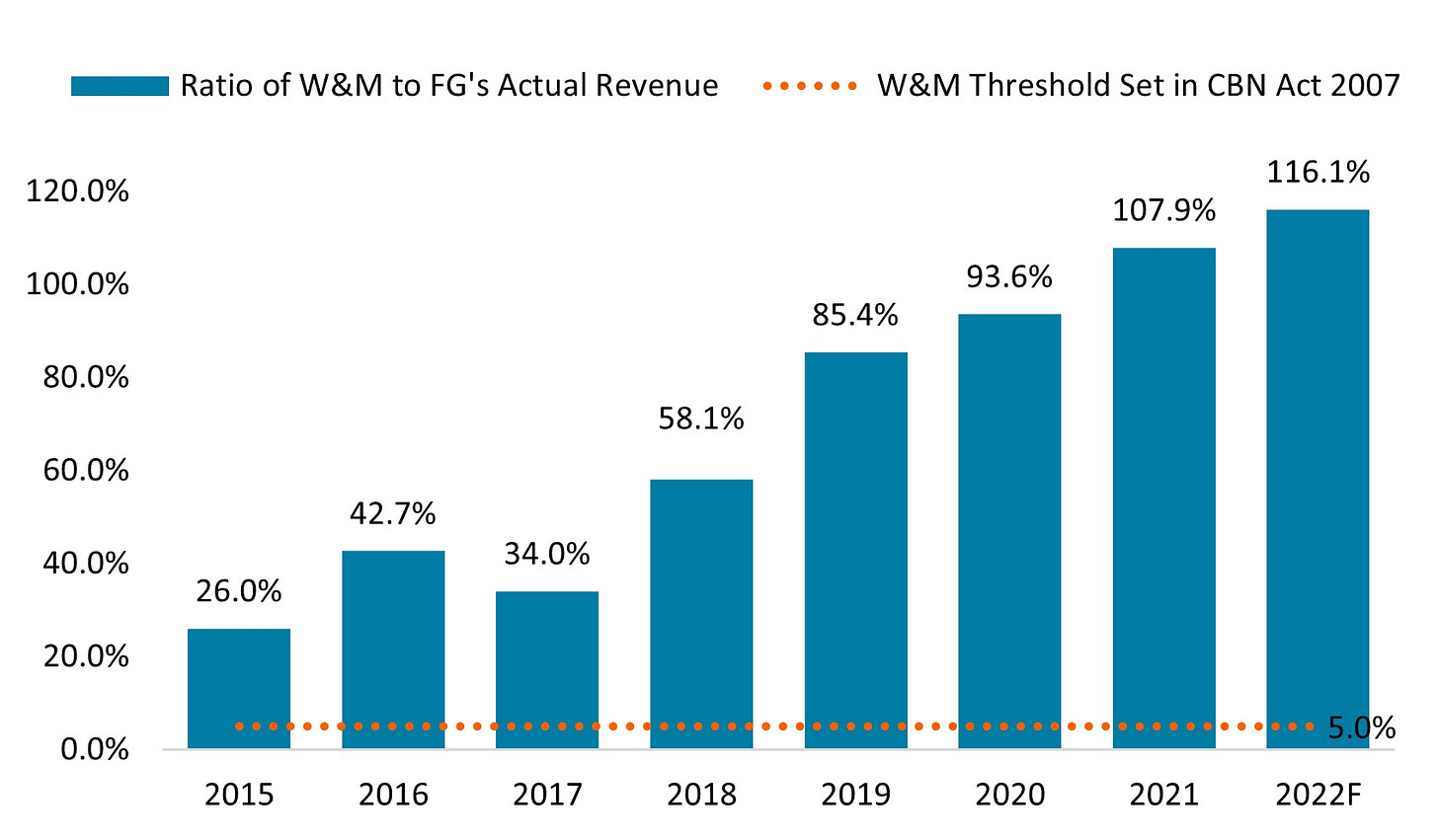

A retrospective glance revealed that FG’s W&M has risen significantly since 2015. For context, total W&M liabilities have increased by more than twenty-fold (+22.3x) over the last 7 years, from barely ₦856.3bn in 2015. Similarly, the ratio of annual W&M disbursement to FG’s Last Fiscal Year (LFY) actual revenue stood at 55.8% as of H1:2022 – a long shot from the 5.0% prudential limit prescribed by the CBN Act 2007. Of course, the consistent spike in W&M financing could be traced to the burgeoning FG’s fiscal deficits as a result of the rising expenditure plan amid muted improvement in revenue generation.

Chart 2: Proportion of Annual Ways & Means Disbursement to Actual FG Revenue Remained Worrisome

Source: CBN, FMFBNP, Afrinvest Research

While one may argue that the CBN is acting on its mandate as the lender of last resort (especially in times of crisis), the fact that the FG can always tap into the coffers of the apex bank incentivizes FG's fiscal expansion – which has contributed to budget deficit growth by more than 300.0% since 2015 – amid poor revenue generation. In addition, the sustained expansion of W&M Liabilities has contributed to the spike in currency-in-circulation with the monetary base rising by 18.2% y/y in the 12 months to June 2022 – a development we believe contributed to the surging inflationary trend. Furthermore, despite the estimated cheap price of the W&M funding (c.7.0% p.a.), its interest payment accounted for a 20.9% share of the total debt service cost over four months (Jan–Apr 2022). This underscores the large-scale nature of W&M in the FG’s loan book.

Unfortunately, we do not expect Nigeria’s fiscal vulnerability to improve materially in the near term given the weak political will to trim recurrent expenditure despite static revenue performance. As such we estimate that W&M advanced to the FG could reach ₦22.6tn by year-end, increasing the ratio of annual W&M disbursement to FG’s LFY actual revenue to 116.1%. While the CBN has defied several calls by global financial authorities and agencies (such as IMF, World Bank, and Moody’s Ratings) to halt deficit financing which has continued to undermine its independent status, we canvass that a timely securitisation of the liability would be a win-win for the FG and the CBN.