Afrinvest Weekly Update | Resilient Services Sector Buoys GDP Growth… MPC to deliver 100-200bps Rate Hike

An Extraction of the Afrinvest Weekly Economic & Market Report for February 23rd, 2024

Photo Credit: NBS

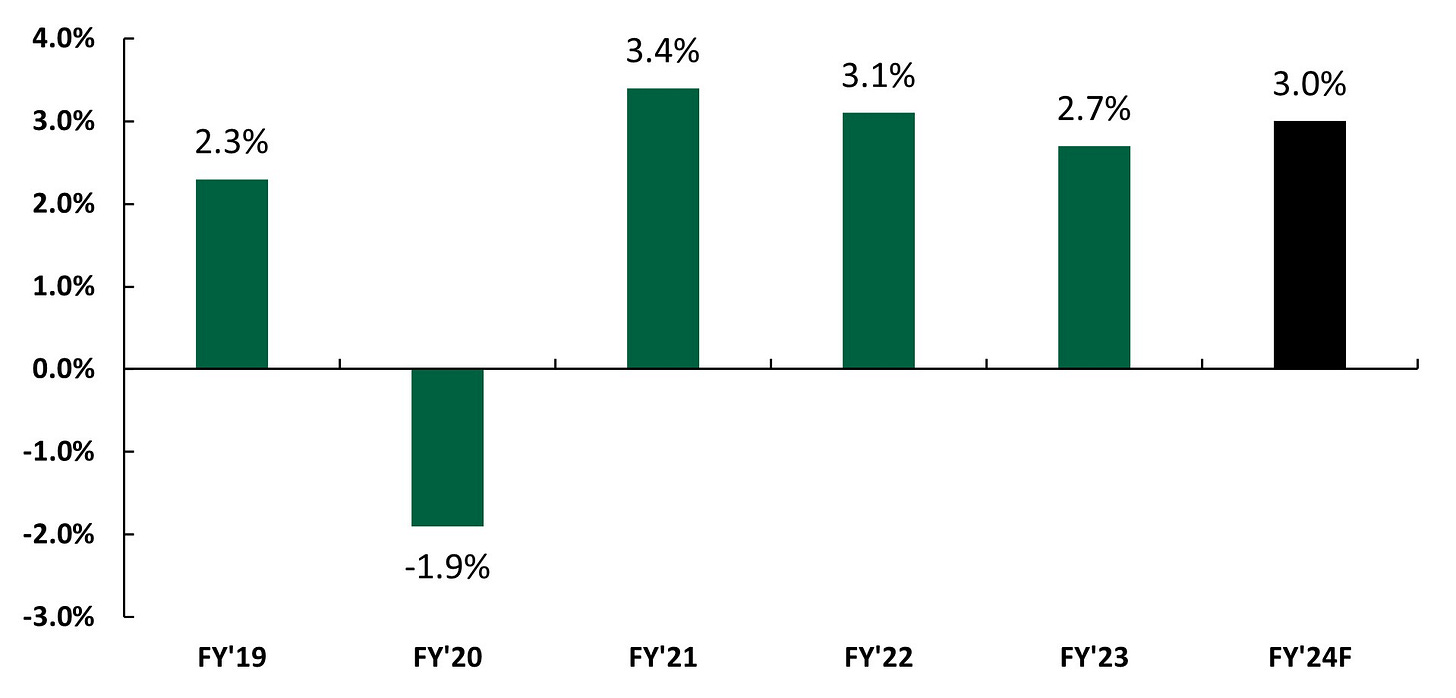

This week, we turn our spotlight to the recently published Gross Domestic Product (GDP) and Capital Importation data for Q4:2023 and share our expectation on the much-anticipated first MPC meeting of the Cardoso-led administration slated for next Monday and Tuesday. In line with our revised projection, Nigeria’s GDP grew 3.5% y/y in real terms in Q4:2023, bringing the annual growth rate to 2.7% (2022: 3.1%). The Q4 GDP performance was mainly supported by the resilient non-oil economy which grew 3.1% (FY'2023: 3.0%), while the oil economy exited its thirteen-quarter long recession spell with growth of 12.1% in Q4:2023. However, on annual basis, the oil economy growth remained in the negative region of 2.2% (FY'2022: -19.2%). On the back of this, the share of oil in the overall economy fell to record low of 5.4% in 2023 from 5.7% in 2022 despite the improvement in the average crude oil production to 1.6mbpd vs 1.4mbpd in the preceding year.

From a structural perspective, the Services sector remained the brightest segment of the economy, while the performance of the Agriculture and Industries’ sectors reinforces cautious optimism in the near term. Precisely, the Services sector expanded 4.0% in Q4:2023 (FY’23: 4.2%), powered by full-year growth in Financial Services (up 26.5% y/y) and ICT (up 7.9% y/y). Also, Trade grew modestly by 1.4% in Q4:2023, bringing the annual growth performance to 1.7% vs 5.1% in 2022. The slower growth exemplifies the challenging operating environment as businesses and households’ purchasing power were devastated by the sharp depreciation of Naira (NGN lost c.49.2% against USD in 2023). Conversely, we attribute the sturdy performance of the Financial Services sub-sector largely to FX revaluation gains while the performance of the ICT activity sector can, in part, be traced to continued infrastructure investment and an expanded subscriber base (up 1.3% y/y to 224.7m in Q4:2023).

Furthermore, the FY’2023 growth of the Agriculture sector printed at 1.1% vs 1.9% in FY’2022 – the lowest in over a decade. This slow growth was driven by the combined impact of prolonged insecurity challenges in the agrarian belt, negative climate change, poor infrastructure, and weak mechanisation, resulting in poor yields and sizeable wastage. Meanwhile, the Industries sector expanded 3.9% in Q4'2023 (FY’2023: 0.7%) largely due to the recovery in the oil economy. This performance masked the devastating impact of FX volatility, runaway inflation, and declining foreign investors interest in Nigeria’s real sectors (Nigeria lost 6 major multi-nationals in 2023).

Looking ahead, our 2024 growth expectation for the broader economy is conservative (blue sky case: 3.0% y/y) compared to FG’s projection of 3.9%. Our position is informed by ongoing reform pains, lack of noticeable improvement in the business environment, incessant insecurity, negative pass-through effect of continued Naira devaluation, and the volatile external environment. Should the fiscal and monetary authorities fail to align properly on all reform areas, our model suggests that the economy could suffer a contraction of c.1.5%, while average inflation rate could worsen to c.32.3% from 24.5% in 2023.

Chart 1: Resilient Services Sector Upholds Growth

Source: NBS, Afrinvest Research

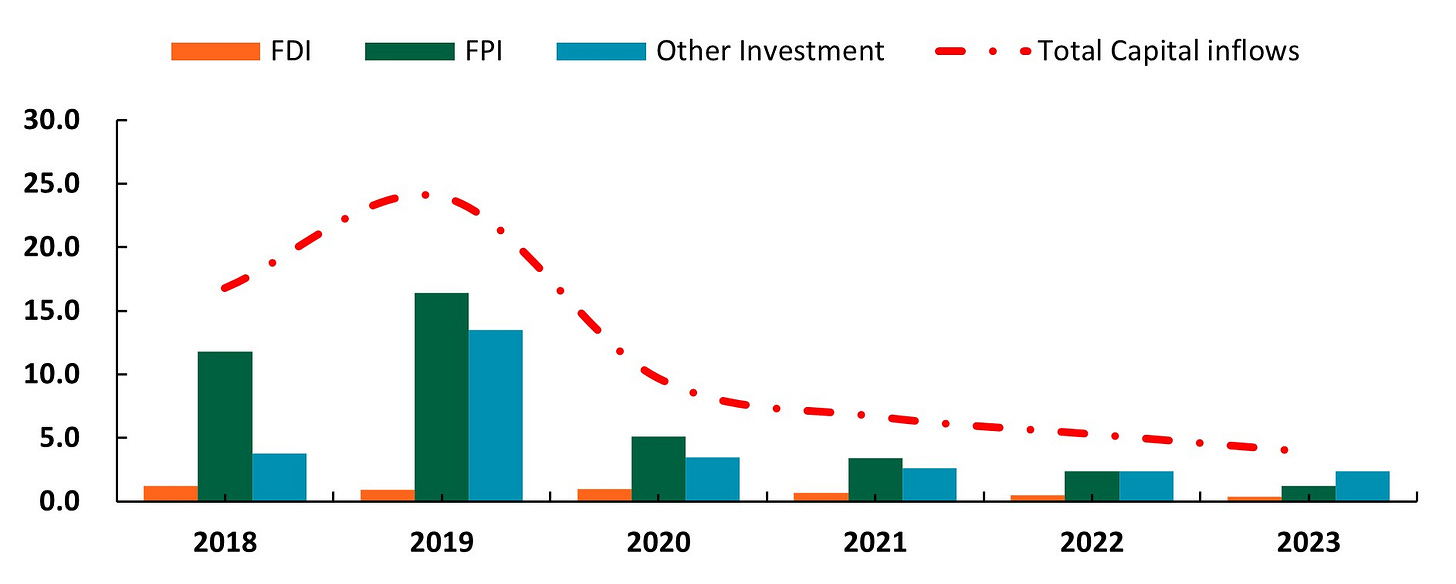

In other developments, total capital importation into Nigeria declined for the fourth consecutive year by 26.7% y/y to $3.9bn in 2023. Notably, the FY print was 18.8% shy of our forecast in October 2023 and represents the weakest inflow since 2007. Disaggregating the data, Foreign Portfolio Investment (FPI) fell 52.8% y/y to its lowest record of $1.2bn, due to aversion to the Money market instruments (-69.5%) and Bonds (-51.6%) although investment in equities grew 342.0%. Consequently, the share of FPI in total capital inflows dipped to 29.5% as against 45.8% in 2022.

Similarly, Foreign Direct Investment (FDI) which accounted for 9.7% of total capital (previously: 8.8%) fell 19.4% y/y to $377.4m in 2023. A breakdown of the FDI data reveals an 18.5% and 99.0% y/y downturn in equity and other capital, respectively. This was evidenced by the exodus of companies such as GSK, P&G, etc., in 2023, implying a decline in foreign investor’s interest in committing to long-term investment with the potential for wealth creation and sustainable growth in Nigeria.

Meanwhile, Other Investments fell 1.8% y/y to $2.4bn on the back of a 0.1% decline in Loans (97.1% of the sub-component). Despite the marginal loss, the share of Other Investments climbed to 60.8%, the highest in at least ten years. Given that Loans represent a large portion of Other Investments, it spells disaster for the Nigerian economy as it speaks highly of her inability to attract patient capital due to the underwhelming ease of doing business, insecurity challenges, and lack of institutional frameworks, among others.

Across sectors, Production/Manufacturing (40.7%), Banking (21.3%), and Financing (11.4%) accounted for the most inflows as 8 sectors recorded growth while 11 declined. Notably, relative to the prior year, funding was heavily skewed to non-financial activities. The top sectors that recorded positive inflows were Transport ($13.3m), IT Services ($226.4m), Drilling ($9.9m), Marketing ($22.1m), and Production/Manufacturing ($1.6bn). In terms of destination, 11 states recorded inflows as against 10 in 2022, although at a significantly lower rate. Also, the narrative remains the same given that Lagos and Abuja (94.0%) account for the lion's share of capital inflows, indicating the need to increase the attractiveness of states in the economy.

While the q/q data may posit a gleam of hope amidst the economic turmoil, the FY data paints a horrific picture of the current reality and tales to come. In our view, efforts by the FG to foster bi-lateral and multi-lateral business relationships have failed to inspire investor confidence in the economy (Q3'2023: $654.7m; Q4'2023: $1.1bn). This is not surprising given the ongoing underlying internal imbalances stemming from high inflation, weakened productivity, FX quagmire, insecurity, increasing poverty, and lean institutional frameworks.

Chart 2: Foreign Investors Apathy Persist

Source: NBS, Afrinvest Research

Lastly, we share our expectations for next week’s MPC meeting. Recall that at the last policy meeting of the MPC in July 2023, the anchor rate – the MPR – was raised by 25bps to 18.75%, in continuation of the Apex Bank’s policy onslaught against Nigeria’s high inflation rate. However, the inflation rate has remained unresponsive to the CBN’s strategy (up 582bps since the last MPC to 29.9% y/y), largely due to a lack of synergy between fiscal & monetary authorities, and the faulty lines in policy transmission mechanisms.

For the upcoming meeting, we anticipate that the MPC might further tighten the anchor rate by 100 - 200bps to 19.5% - 20.5%, premised on stubborn domestic inflation, reluctance of global systemic central banks to cut rates, and the positive but modest domestic GDP growth numbers for FY’23. However, we canvass that the monetary authority should also consider stemming the growth of money supply in the financial system as broad money supply surged 76.4% y/y to an all-time high of ₦93.7tn as of January 2024. The alarming growth in money supply might be detrimental to the efforts of the Apex Bank to stem the runaway inflation rate. In all, we do not see the MPC keeping rates constant, given the need to incentivise liquidity mop-up to tame inflation. Hence, an “HOLD’ stance is highly unlikely.