Afrinvest Weekly Update | MF Upbeat on Nigeria’s Reform… Trade Surplus Dampened by Accelerated Import Bills

An Extraction of the Afrinvest Weekly Economic & Market Report for March 8th, 2024

Photo Credit: NBS, Afrinvest Research

This week, we spotlight the post-Article IV Consultation assessment note on Nigeria by the International Monetary Fund (IMF) and the Q4:2023 Merchandise Trade Statistic by the NBS. For context, IMF Article IV Consultation is an annual exercise in which staff of the Bretton Woods institution meet with key decision makers (fiscal and monetary) and stakeholders in the country of interest to assess the trajectory of key macroeconomic indicators and policy actions, with a view to providing recommendations and support where necessary. The IMF in the latest assessment note on Nigeria averred that:

(i) Improved oil production (January’s 1.6mbpd is the highest in 24 months) and an expected better harvest in H2:2024 are positive for GDP growth, which the IMF projected to reach 3.2% in 2024 (2023: 2.7%), although high inflation, weaker naira, and monetary policy tightening were sighted as potential downside factors;

(ii) FG’s recent approval of an effective and well-targeted social protection system including the directive to release grains, seeds, and fertilizers, as well as the introduction of dry season farming is an important step, given that about 8.0% of the population is deemed to be food insecure;

(iii) The recently approved Targeted Social Safety Net Programmes be fully implemented before the government completely removes the implicit but costly subsidies on fuel and electricity tariffs (estimated to gulp c.3.0% of GDP in 2024) to ensure low-income households are protected; and

(iv) The recent decision of the CBN’s monetary policy committee to tighten the benchmark rate (amongst others) is commendable and should help to stem the current high inflation tide in the near term.

We remain cautiously optimistic about Nigeria’s growth projection for 2024 (bluesky case: 3.0%) due to the inability of the fiscal authorities to lead by example in cutting down on non-essential consumptions which in our view, is pivotal to the reform prognosis of the current administration. Furthermore, we are currently oblivious to any new framework for the revamped Social Safety Net Programme which IMF staff dubbed “effective and well-targeted”. Hence, we hold that any unwholesome adjustment to the scheme’s framework under the Buhari administration (where no clarity was provided on the criteria used for picking beneficiaries and the register for the over 3.0m beneficiaries could not be accounted for) would also deliver a sub-par outcome.

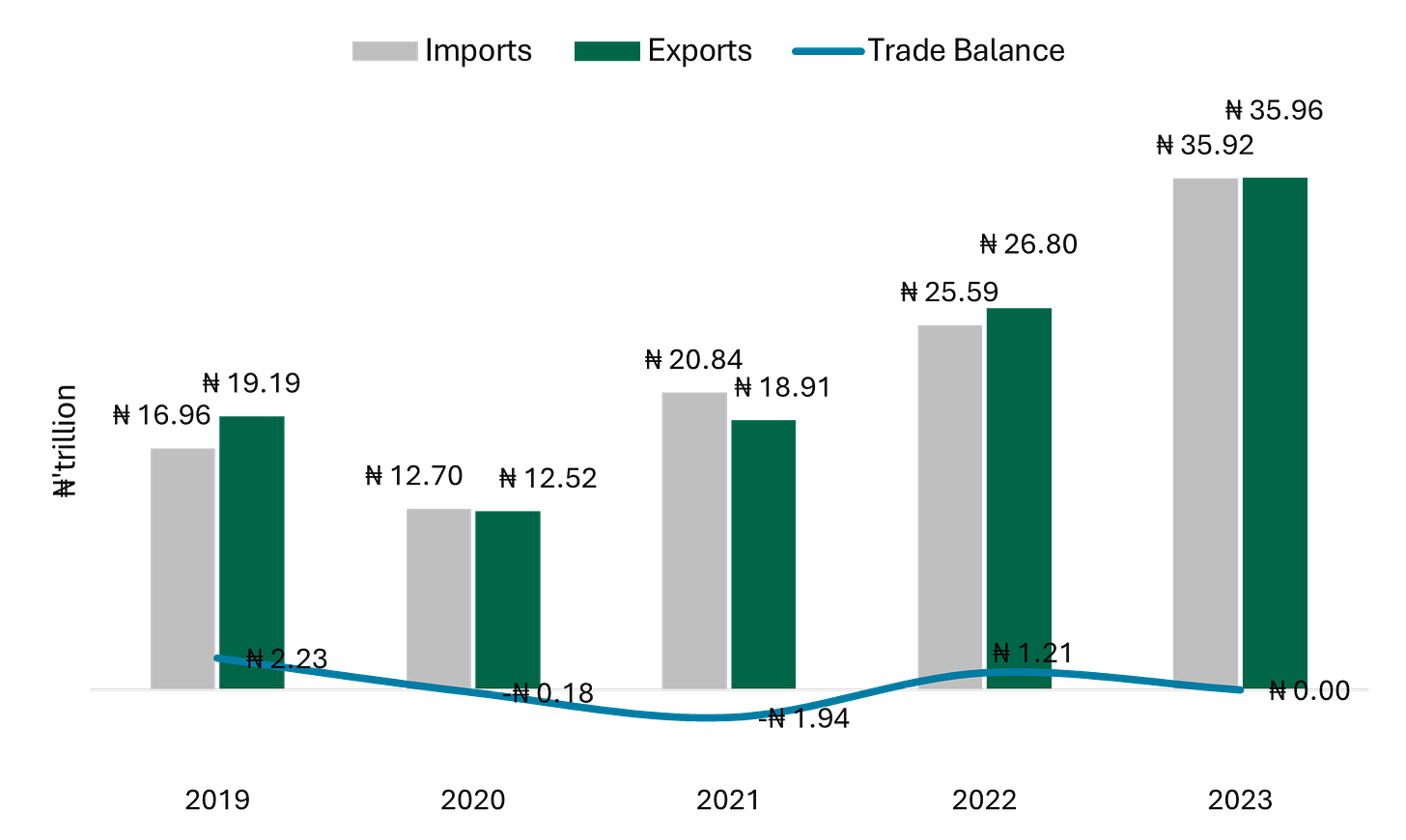

Shifting focus, NBS data revealed that Nigeria recorded a trade deficit of ₦1.4tn in Q4:2023 as import expense growth (up 56.0% q/q to ₦14.1tn) outpaced export earning growth (up 22.7% q/q to ₦12.7tn). However, on an annual basis, the country’s trade position closed on a modest gain as export earnings (₦35.96tn) outpaced import bills (₦35.92tn) by ₦2.9bn. We flagged that the material spike in import expenses in Q4 was due to the 493.3% m/m jump in manufactured goods import bills in September 2023 to ₦6.5tn, owing to the country’s purchase of Tanks and other armoured fighting vehicles, motorized, and whet from Singapore (this costs a total of ₦5.1tn).

Disaggregating the export earnings performance, we observed that the share of non-oil and non-crude earnings fell by 80bps and 10bps y/y respectively while crude oil export earnings share strengthened to 80.6% from 78.7% in 2023. Aside from crude oil and related items, agriculture remains Nigeria’s largest non-oil export, accounting for a 3.7% share of total exports in Q4:2023 followed by raw material goods (2.6%), and manufactured goods (1.9%). Sesame seed and Cocoa variants remain Nigeria’s major agriculture export commodity, accounting jointly for about 75.7% share of non-oil export earnings in Q4:2023 and c.76.4% for the whole year.

Nigeria’s top three import sources in Q4:2023 were Singapore (36.1%), China (14.6%), and Belgium (8.1%) while leading export destinations were the Netherlands (15.1%), India (8.7%), and Spain (8.1%). Also, Nigeria booked trade surpluses over Africa (₦2.8tn), the Americas (₦2.6tn), Europe (₦4.1tn), and Oceania (₦44.8bn) while it posted a record deficit with Asia (₦9.5tn) due to the huge import from Singapore in September. We estimate Nigeria’s trade position to return to the positive region in Q1:2024 (base case: ₦650.0bn and best case: ₦1.0tn) supported by the gradual improvement in crude oil production and stable crude oil price above the $77.96/bbl. budget benchmark. Nonetheless, we hold that this projected gain will have a negligible impact on the country’s FX reserves position, given the continued deficit position in the services account and the recently uninspiring performance of the income and transfer account segments of the country’s current account.