Afrinvest Weekly Update | Inflationary Pressure Mounts to New Height… FX Conversion Gains Support New Record Level VAT and CIT

An Extraction of the Afrinvest Weekly Economic & Market Report for March 15th, 2024

Photo Credit: NBS, Afrinvest Research

This week, we spotlight the three national statistics published by the NBS – the Consumer Price Index (CPI) data for February 2024, Company Income Tax (CIT), and Value Added Tax (VAT) numbers for FY:2023 respectively.

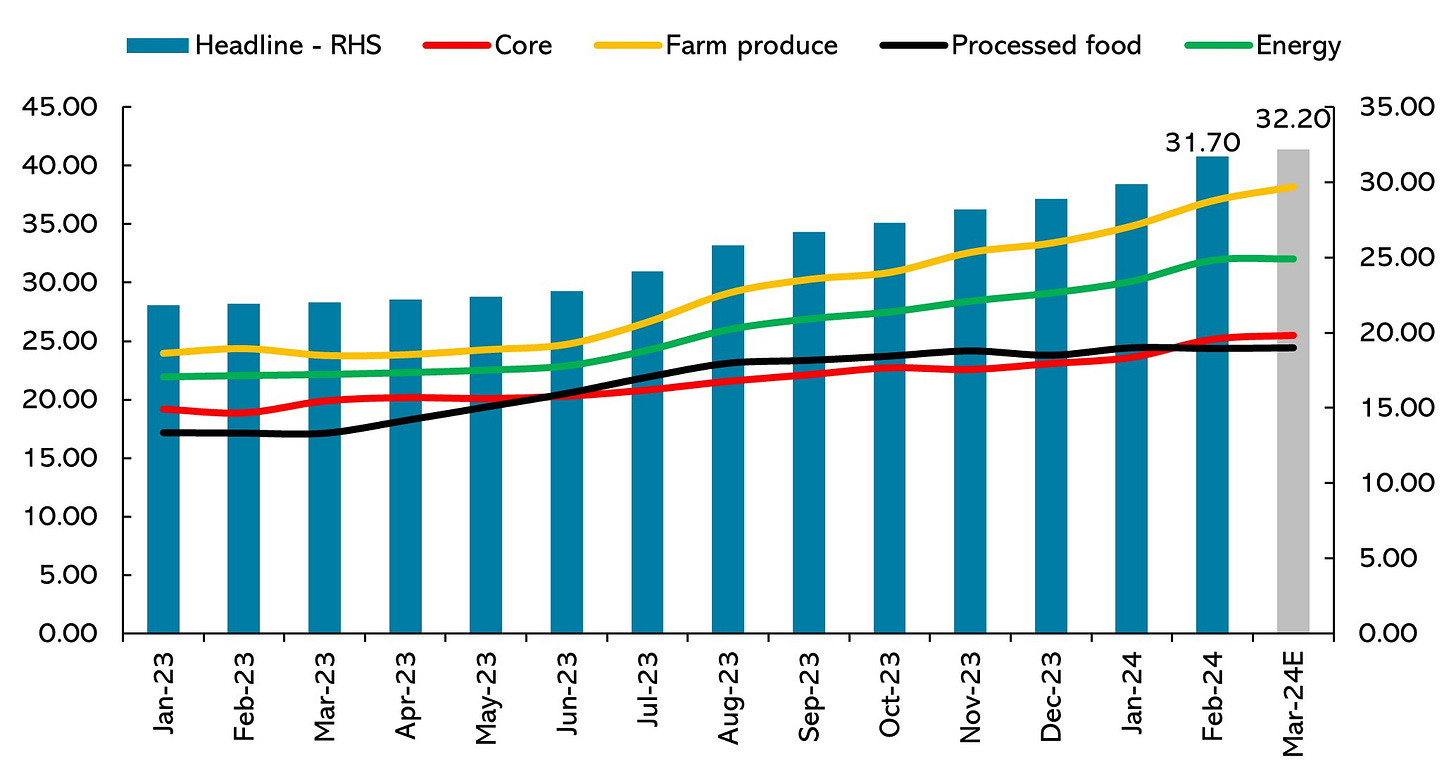

Starting with CPI data, Nigeria’s headline inflation rate advanced for the fourteenth consecutive month by 180bps y/y to 31.7% in February 2024 – a new record high in over three decades based on CBN and NBS data. From a m/m perspective, the headline rate printed at 3.1% (prior month: 2.6%), reflecting continued price pressure on both the food and core inflation sub-baskets. Diving deep, the food inflation index nudged higher to a record 37.9% y/y (previously: 35.4%), while the m/m reading printed at 3.8% from 3.2% in January 2024, making it the highest since the NBS began tracking the data in 2009. We hold that the rising food prices are due to local supply shortfalls resulting from prolonged insecurity and large-scale sabotage, negative pass-through of high energy goods prices on logistic costs, imported inflation, as well as continued Naira depreciation (the official NGN-USD rate fell further by 9.6% to ₦1,595.11/$ at the end of February).

As per the core inflation sub-basket (which represents all items less farm produce & energy), the y/y reading accentuated by 153bps to 25.1%, although on a m/m basis the index tempered by 7bps to settle at 2.2% - the first decline in four months. The leading drivers of the spike in the y/y core inflation rate were road transportation costs, actual & imputed rentals for housing, medical services, and pharmaceutical products coupled with low base year effect. Based on our estimation, energy goods inflation climbed 180bps y/y and 49bps m/m to 31.1% and 3.2%, respectively in February.

Looking ahead, we estimate that the headline rate should increase by 54bps y/y in a base case scenario to 32.2% in March, driven by the disruption in local food supply flows from North to South amid the ongoing Ramadan. Also, subsisting pressure from legacy challenges and negative pass-through from inflation resurgence in key advanced market (US headline rate nudged higher to 3.2% y/y in February from 3.1% the prior month) should keep price pressure elevated throughout Q1:2024.

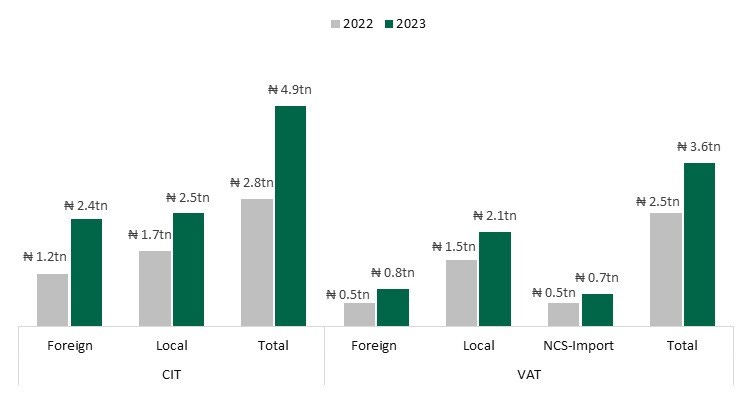

Switching focus, the latest NBS data revealed that Nigeria’s gross non-oil tax revenues from CIT and VAT improved by 73.0% and 44.9% y/y, respectively to ₦4.9tn and ₦3.6tn in 2023 – the highest nominal values on NBS record. Disaggregating proceeds by collection sources, we observed that foreign CIT payment rose faster (up 107.4% y/y to ₦2.4tn) than the domestic CIT (up 49.5% y/y to ₦2.5tn), although the latter still accounts for majority share (51.3%) of the total collection (₦4.9tn). Likewise in the VAT collection segment, non-import foreign VAT sub-component rose the highest, up 61.4% y/y to ₦824.6bn. This was followed by local non-import VAT which grew 42.0% y/y to ₦2.1tn, while Nigerian Customs Service (NCS)-import VAT advanced 37.0% y/y to ₦714.5bn. We averred that the significant spikes in foreign CIT and VAT segments may not be unconnected to the exchange rate conversion gains, given that the Naira official rate parred by c.49.2% against the USD in 2023.

Disaggregating the CIT performance by sectoral contribution, we note that the financial and insurance activities sector CIT rose the highest, up 119.6% y/y to ₦458.8bn. This, we believe, reflects the dramatic growth of the sector GDP in 2023 (up 26.5% y/y to emerge as the fastest-growing sector for the year), following the positive knock-on effect of FX revaluation gains on the earnings and profitability of most sector players (our estimation of the 9M and FY earnings of listed banks revealed that their top and bottom line numbers grew by over 45.0% and 70.0% y/y, respectively on average). Despite the challenging business environment and the attendant devastating bottom-line performances of key manufacturing sub-activities (notably, the brewery segment), manufacturing CIT grew 33.7% y/y to ₦626.4bn to remain the largest contributor to domestic CIT with 24.9% share, trailed by ICT (18.6%) and finance & insurance (18.3%) activity segments. We hold that this sturdy performance was inspired by improved compliance by companies in these segments (even for outstanding bills), owing to the full adoption of the TaxPro Max technology by the FIRS.

For the VAT segment, we noticed remarkable growth in arts, entertainment & recreation VAT (up 148.5% y/y to ₦9.3bn), wholesales & retail trade and repair of motor vehicles & motorcycles VAT (up 103.6% to ₦138.1bn), and financial & insurance activities VAT (up 97.5% y/y to ₦215.8bn). We attribute the growth in these activity segments’ VAT to the structural shift in payment and settlement medium in Nigeria since the botched Naira redesign programme of the CBN in Q1:2023 and the subsequent reduction in paper notes in circulation evident by the 55.0% y/y surge in electronic transactions value to ₦600.0tn in 2023 (NIBBS data). Also, the inability of most individuals and corporates to max out the weekly cash withdrawal caps of ₦500,000 and ₦3.0m respectively supported the push to digital channels.

Even with the provision that allows for up to 50.0% deduction as cost of collection on CIT and the uneven distribution model of net VAT (FG share: 15.0%, States share: 50.0% and LGs share: 35.0%), the FG’s actual CIT available for the budget already outperformed the annual set target by 66.0% at ₦1.5tn in 9M:2023, while VAT was just 16.7% adrift of the annual target of ₦383.1bn as per data from the ministry of budget & economic planning. Projecting for 2024, we flag that the growth of these non-oil tax revenue channels could slow considerably (to the detriment of fiscal capability), should the lingering downside risks in the business environment (notably, the dwindling consumer purchasing power due to the sky-high inflation rate) persists.